From Flapdoodle to Forecasts:

A Futurist’s Take on America’s Economic Drivers

Putting the theory in practice, I have been road testing different Ai platforms and putting them through their paces. At present, an AI is like a new intern. Eager to please, often wrong and occasionally brilliant. Give it a task and it will be roughly 80% correct leaving you to fill in the last 20% and back check for accuracy.

Then came a long back and forth, sector by sector. Eventually, I wanted a summary, but not just any summary, one that could tie back to simple Mind Sets to help convey the key takeaways.

Here is the answer:

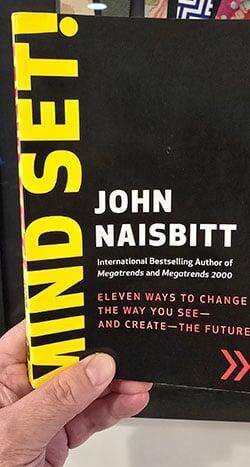

Absolutely! Here’s a futurist sector outlook for “What Drives the U.S. Economy Next - 2025 and beyond through the lens of John Naisbitt’s "Mind Set!" principles. This analysis blends your earlier economic themes with actionable, forward-looking insights, making it suitable for strategic planning, investor decks, or thought leadership.

1. Understand How Powerful It Is Not to Have to Be RightImplication:The U.S. economy is entering an era of uncertainty-demographic headwinds, fiscal imbalances, and global competition. Policymakers, business leaders, and investors must accept that no single forecast will be “right.”Action:Embrace scenario planning, rapid prototyping, and policy experimentation. Encourage public-private partnerships that can pivot as conditions change.

2. See the Future as a Picture PuzzleImplication:No single trend (AI, deglobalization, energy transition) will define the next decade. Instead, the U.S. economy will be shaped by the interplay of technology, policy, demographics, and geopolitics.Action:Build coalitions across sectors (e.g., energy + data + logistics), and use data analytics to spot emerging patterns. Invest in platforms and networks that connect disparate pieces of the economic puzzle.

3. Don’t Get So Far Ahead of the Parade That No One Can Hear the Music”Implication:While AI and advanced manufacturing are transformative, much of the economy still runs on legacy systems and human capital.Action:Balance investment in breakthrough technologies with upskilling and infrastructure renewal. Don’t abandon the “old economy” before the “new economy” is ready for mass adoption.

4. Don’t Add Unless You SubtractImplication:The U.S. economy is burdened by regulatory complexity, outdated incentives, and overlapping programs.Action:Streamline regulations, sunset obsolete subsidies, and focus on policies that deliver measurable ROI. Encourage businesses to prune non-core activities and double down on what drives value.

5. Don’t Get Caught Up in the ‘Flapdoodle’***Implication:Beware of hype cycles-whether in green tech, AI, or “reshoring.” Not every trend is a transformation.Action:Invest in what’s proven and scalable. Build trust by focusing on transparency, data, and real outcomes-not just buzzwords.

6. While many things change, most things remain constantImplication:Despite volatility, certain needs endure: energy security, skilled labor, resilient infrastructure, and capital access.Action:Anchor economic strategy in these constants. For example, workforce development and grid modernization will remain priorities regardless of political shifts.

7. Remember “That the Future Is Embedded in the Present"Implication:Today’s pilot projects, local innovations, and policy experiments are the seeds of tomorrow’s economic engines.Action:Scale what works-whether it’s a successful regional cleantech cluster, a new apprenticeship model, or a public-private infrastructure partnership.

8. See the Future as a Kaleidoscope”***Implication:Expect recombination: legacy industries will merge with new tech (e.g., AI in logistics, biotech in agriculture), and global capital will seek new local partners.Action:Foster cross-sector and cross-border collaborations. Build platforms that can adapt as the economic “kaleidoscope” shifts.

Futurist-Informed Sector Outlook - 2025 and beyond

Strategic TakeawaysAI and Automation:Will drive productivity, but require parallel investment in worker retraining and digital infrastructure.Energy Transition:Cleantech will remain a growth engine, but only for firms that can prove market viability and resilience to policy swings.Regionalization:The U.S. will see economic divergence-states and metros that invest in talent, infrastructure, and innovation will pull ahead.Resilient Supply Chains:Expect continued “friendshoring” and localization, but also new global partnerships in critical minerals, semiconductors, and advanced manufacturing.Demographics and Immigration:Population aging and labor shortages will force a rethink of immigration, education, and workforce policy.Fiscal Sustainability:Rising debt and entitlement costs will eventually drive a reckoning-either through policy reform or market-driven discipline.

Stay Adaptable:The next U.S. growth drivers will be found at the intersection of enduring needs and new capabilities.Invest in Ecosystems:Platforms, networks, and partnerships will outperform isolated bets.Balance Boldness with Prudence:Fortune favors the bold-but only those who are grounded in data, humility, and a willingness to pivot.

Let me know if you’d like this tailored for a particular sector or expanded for a white paper or leadership presentation!

###

After being at the center of geopolitics, geoeconomics, economic development, real estate development, site selection and architecture for over 35 years, this was a great glimpse into the road ahead.

Notes:

***Like all LLMs Perplexity Hallucinates. Perplexity reworded two terms from the original, and I had to go to the source material to back check.

"flapdoodle" While a hallucination, the term is much better than “focus on the score of the game.”“Kaleidoscope” When questioned, Perplexity went meta and thought “Picture Puzzle” was too limiting. See discourse below:

Picture Puzzle vs. Kaleidoscope: What’s the Difference?

Picture Puzzle (Naisbitt’s Mind Set #5)

Original Meaning:

Naisbitt’s “see the future as a picture puzzle” encourages leaders to assemble disparate pieces of information to form a coherent image of what’s coming. It’s about pattern recognition: collecting data points, connecting dots, and synthesizing a clear picture from complexity.

Limitation:

Implies there is one “correct” image to be revealed if you have all the pieces and fit them together properly.

Kaleidoscope (Naisbitt’s Mind Set #11 and Futurist Thinking)

Expanded Meaning:

The “kaleidoscope” metaphor goes further. It suggests the future is not a static image but a dynamic, ever-changing pattern. With each turn (policy change, tech breakthrough, market shock), the pieces rearrange to form new, sometimes surprising patterns. There’s no single “solution”—just evolving opportunities and risks.

Why It Matters:

This aligns with the real-world: technologies, regulations, and alliances are constantly shifting, recombining in new ways. Success requires adaptability, not just analysis.

In case you were wondering, here is the original version of the Eleven Mindsets

John Naisbitt’s Mind Set!: Reset Your Thinking and See the Future (2006).

I hope you found this exercise useful and thought provoking as we navigate this era of uncertainty and opportunity.

- While many things change, most things remain constant

- The future is embedded in the present

- Focus on the score of the game

- Understand how powerful it is not to have to be right

- See the future as a picture puzzle

- Don’t get so far ahead of the parade that people don’t know you’re in it

- Resistance to change falls for benefits

- Things that we expect to happen always happen more slowly

- You don’t get results by solving problems but by exploiting opportunities

- Don’t add unless you subtract

- Don’t forget the ecology of technology

Michael Edgar, Founder and CEO

SelectGlobal, LLC

There is a lot of great lessons in the book.

Additional Case Studies including a discussion of

from Nation States to Economic Domains